Mistral AI and ASML: understanding the investment and its implications for Europe

September 9, 2025 marks a key date for European tech. The Dutch giant ASML, the leading supplier of lithography machines, announced a €1.3 billion investment in the French startup Mistral AI, an emerging leader in artificial intelligence. The operation, part of a €1.7 billion Series C funding round, values Mistral AI at €11.7 billion and positions the company as the most highly valued AI player in Europe. But beyond the numbers, this strategic partnership reveals broader ambitions: strengthening European technological sovereignty and redefining Europe’s place in the global battle for semiconductors and artificial intelligence.

A unique alliance between semiconductors and artificial intelligence

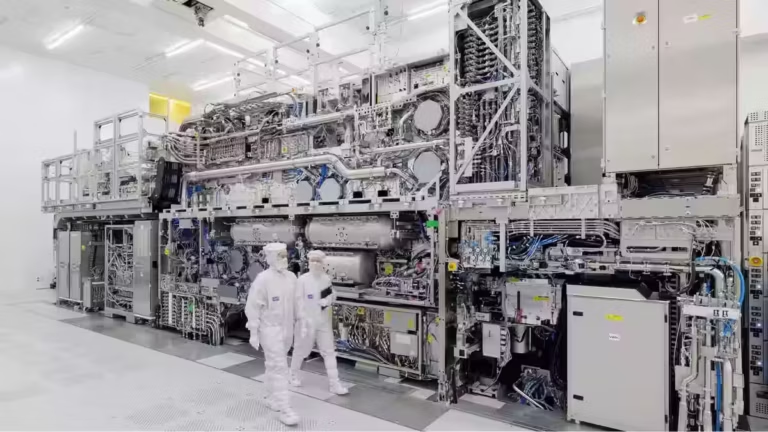

ASML is not just any company. The group holds a near-monopoly on EUV lithography machines, essential for manufacturing the most advanced chips used in smartphones, data centers and especially AI accelerators designed by NVIDIA or AMD. Without ASML, it is impossible to produce processors etched at 3 nanometers or less, which are vital for the global digital economy as highlighted by Forbes.

On the other hand, Mistral AI was founded in 2023 by a team of researchers from Google DeepMind and Meta. In just two years, the startup has established itself as a credible European alternative to American and Chinese AI giants in generative AI. Its approach focuses on open, modular and multilingual models, already adopted by more than one hundred clients. According to L’Usine Digitale, the company shows a recurring annual revenue of €312 million, 15 models available and around 350 employees across six international offices.

The alliance between these two champions is far from trivial. It aims to integrate Mistral’s AI models directly into ASML’s industrial products and processes. In an official ASML press release, Christophe Fouquet, CEO of ASML, explained that the collaboration should generate “clear benefits for ASML’s customers through innovative solutions made possible by AI.”

A massive investment and a seat on the strategic committee

At the heart of this announcement lies the record €1.7 billion funding round. ASML is the main contributor with €1.3 billion, thus becoming a shareholder with nearly 11% of the diluted capital. In return, the Dutch group obtained a seat on Mistral AI’s strategic committee, held by its CFO, Roger Dassen (ASML). This consultative role gives ASML significant influence over the startup’s technological and strategic directions.

The funding round also includes historical investors such as DST Global, Andreessen Horowitz, Bpifrance, General Catalyst, Index Ventures, Lightspeed and NVIDIA, according to Mistral AI.

Optimizing lithography with AI

The ambitions go far beyond capital. ASML generates terabytes of data every day during the production and analysis of its lithography systems. These data sets cover defects, transistor quality and energy efficiency. The goal is to turn this massive volume of information into operational intelligence, capable of predicting failures, optimizing yields and accelerating innovation cycles.

Take for example ASML’s new High-NA EUV machines, capable of etching at 8 nanometers, or about 25 aligned silicon atoms. At such a scale, quantum effects can disrupt production. Mistral’s AI models could adjust manufacturing parameters in real time, ensuring consistent quality despite these uncertainties as noted by Forbes.

A strong geopolitical dimension

Beyond the technical aspects, this agreement sends a major geopolitical signal. In the context of technological rivalry between the United States and China, Europe struggles to assert itself globally. Generative AI is dominated by OpenAI, Google, Meta and Anthropic on the American side, while semiconductor production remains concentrated in Asia, particularly in Taiwan. The European Union currently represents only about 10% of global production.

With this deal, ASML and Mistral AI aim to build an autonomous European tech hub. As Forbes highlights, this investment “must be read as a rebalancing attempt” in the face of American pressure on ASML’s exports to China. By becoming a shareholder in a French AI champion, ASML strengthens the European ecosystem while diversifying its strategic alliances.

Mistral AI, independence reaffirmed

Arthur Mensch, co-founder and CEO of Mistral AI, emphasized that this funding “reaffirms the company’s independence.” By combining its software expertise with ASML’s industrial power, Mistral AI aims to accelerate the development of decentralized and customized models, adapted to the needs of strategic industries (Mistral AI).

To conclude, it should also be remembered that ASML did not carry out this operation alone. The Dutch group injected €1.3 billion, becoming an 11% shareholder and obtaining a seat on Mistral AI’s strategic committee. But the funding round also included NVIDIA, Bpifrance, Andreessen Horowitz, DST Global, General Catalyst, Index Ventures and Lightspeed, alongside historical investors (Mistral AI). While the exact share of these players has not been disclosed, it is clear that ASML’s arrival reshapes the balance, making the Dutch champion the main external shareholder, while the founders remain majority holders as highlighted by Le Monde.

What to watch

- Technical integration: how long will it take before Mistral’s models are fully integrated into ASML’s machines?

- Tangible results: what measurable improvements in yields and preventive maintenance will be observed?

- The exact role of ASML: the seat on the strategic committee is consultative, but could weigh more heavily as the collaboration deepens.

- European market evolution: will this partnership inspire other alliances between industrial champions and AI startups?

Your comments enrich our articles, so don’t hesitate to share your thoughts! Sharing on social media helps us a lot. Thank you for your support!